Living in Kenya for some time, one notices that illegal immigrants from neighbouring countries constitute a serious social problem. Despite reinforced immigration laws to stem the flow, the problem continues to grow.

As a Chinese saying goes, “people seek to ascend higher, while water flows down.” This more or less reflects Kenya’s relatively better economic condition than its neighbours, Statistics show that since 1985, the total output value of Kenya has increased by 5.1 percent annually, and the per-capita income by 1.2 percent.

In recent years, many third world countries experienced economic stagnation, burdened by heavy debts, and per-capita income dropped constantly. However, Kenya’s economy maintained a stable growth rate.

Kenya’s favourable economic situation can be attributed to years of favourable weather and successive good harvests. Moreover, the readjustment of the economic structure played a positive role. Kenya promptly converted the import-substitute economy into an export-oriented economy, thus injecting new life into the economy.

In the 1970s, oil prices on the international market soared; the East-African Community disintegrated and the Kenyan domestic market became saturated. These factors impelled Kenya to reform its economic structure.

During the early days after independence, Kenya set up a number of state-owned enterprises to protect the national economy. But most enterprises relied on government subsidies because of poor operation and management. Besides, the government monopolized such welfare services as health and education, resulting in a growing financial deficit.

Kenya started reforming its economic structure in 1976, in an effort to improve the balance of international payments and the financial deficit that handicapped economic development.

The reform began by cutting government expenditures. To do so, the government took four major measures: First, some state-owned enterprises concerned with the production and sale departments of the national economy were gradually changed into privately-owned enterprises. Second, a “fund sharing policy,in which the beneficiary would share part of the costs with the government, was practised in welfare departments such as health and education. Third, the wage growth rate was limited within 75 percent of the increased rate of living expenses. Fourth, the assignment of college graduates or trainees of government departments was no longer monopolized by the government.

Meanwhile, the Kenyan government increased bank interest rates to encourage personal savings and absorb idle funds. In the past, Kenya had practised a low-interest rate policy, with rates lower than the inflation rate. As a result, people would not deposit their money in the bank. As of 1980, banks gradually increased interest rates from 5 percent to 10 and 12 percent. To avoid raising funds from the local money market, the government borrowed money from abroad to make up for the financial deficit. At the same time, a certain amount of funds were guaranteed in the local market to develop the economy.

Kenya controls its unfavourable balance of payments by expanding exports and increasing foreign exchange income. Apart from traditional products like coffee and tea, energetic efforts have been made by Kenya to develop the growing of flowers, fruits and vegetables, as well as tourism, so as to increase its foreign currency earnings. In recent years, the earnings in foreign currency increased by 20 to 30 percent annually. Tourism has become the largest foreign currency earning trade, exceeding coffee and tea.

Kenya also encouraged the export of industrial products. To create favourable conditions for export, the government took the following measures: 1. Practising a floating rate and gradually devaluating the currency. In 1980, 7.42 Kenyan shilling equated one US dollar, but in 1990, it took 23.156 Kenyan shilling for one US dollar. 2. Cancelling import restraints over some goods and easing price control over other products in an effort to promote the quality of local goods and reduce their cost—thus encouraging competition. 3. Practising export subsidy and bonded policy. 4. Establishing export processing zones and providing various preferential treatments to attract foreign and local funds and develop export goods.

In the process of economic reorganization, Kenya has attached great importance to developing its agriculture, especially grain production. For instance, the purchasing prices of farm products are constantly adjusted.

This effective measure aroused the enthusiasm of farmers for production, guaranteed a yearly increase of farm product exports, such as coffee and tea, as well as a stable growth of grain production. Since 1990, Kenya has accelerated its reform in an attempt to become “Africa’s little dragon” (in China, the dragon symbolizes a strong economy).

In 1990, a privately invested processing zone was put into operation and in the next two years, two other export zones will be completed.

However, Kenya’s reform on economic structure is not all smooth-going. At present, Kenya is heavily burdened with foreign debts and the figure reached US$5.7 billion in 1990. Some 34 percent of export income should be used to repay principal and interest. It has become an unfavourable factor for the economic development. Meanwhile, city residents’ income is somewhat declining, unemployment is soaring and the population increase is at its peak. In addition, there are some external factors beyond control.

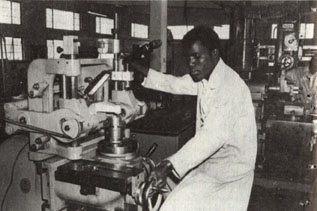

A machine spare parts factory in Nairobi. XIN HUA

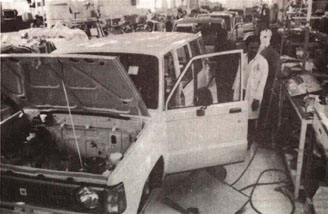

An automobile assembly line at a Kenyan-American joint venture. XIN HUA

Copy Reference

Copy Reference